Complete Guide to Minimum Wage Rules in Assam

The Assam government updated its minimum wage structure in June 2023, ensuring equitable pay across sectors by classifying workers based on their skills and job roles. Categories include unskilled workers, semi-skilled/unskilled supervisory, skilled/clerical workers, highly skilled workers, Assistant Security Officers (ASO), supervisors, armed gunmen, and unarmed security guards. These revised wages reflect the responsibilities and expertise needed for each position. Employers are required to follow these new rules, with enforcement handled by the Labour Department, which imposes penalties for non-compliance. Workers are advised to report any wage-related concerns to uphold their rights.

Detailed Guide to Minimum Wage Regulations in Assam

Legal Overview of Minimum Wage Policies in Assam

The minimum wage policies in Assam are governed by the state’s labour laws, which ensure that workers receive fair compensation for their work, reflecting the economic conditions and the cost of living. The revised minimum wage rates, effective from June 2023, categorize workers into various classes based on their skills and job nature. These categories include unskilled workers, semi-skilled/unskilled supervisory, skilled/clerical workers, highly skilled workers, ASO, supervisor, gunmen (armed), and security guards (unarmed).

Key Legal Guidelines:

Minimum Wage Rates: Wage rates are updated regularly to match inflation, and employers must comply to ensure fair pay.

Category-Based Wage Structure: Wages vary based on skill level and job classification.

Compliance Requirement: Employers must pay at least the minimum wage, with non-compliance leading to fines.

Record-Keeping: Employers must maintain accurate records of wages, hours, and attendance, and provide payment slips.

Working Hours and Overtime: Standard working hours are defined, with overtime paid at a higher rate.

Enforcement and Inspections: The Labor Department ensures compliance, with workers able to file complaints if underpaid.

Current Minimum Wage Rates and Regulations in Assam

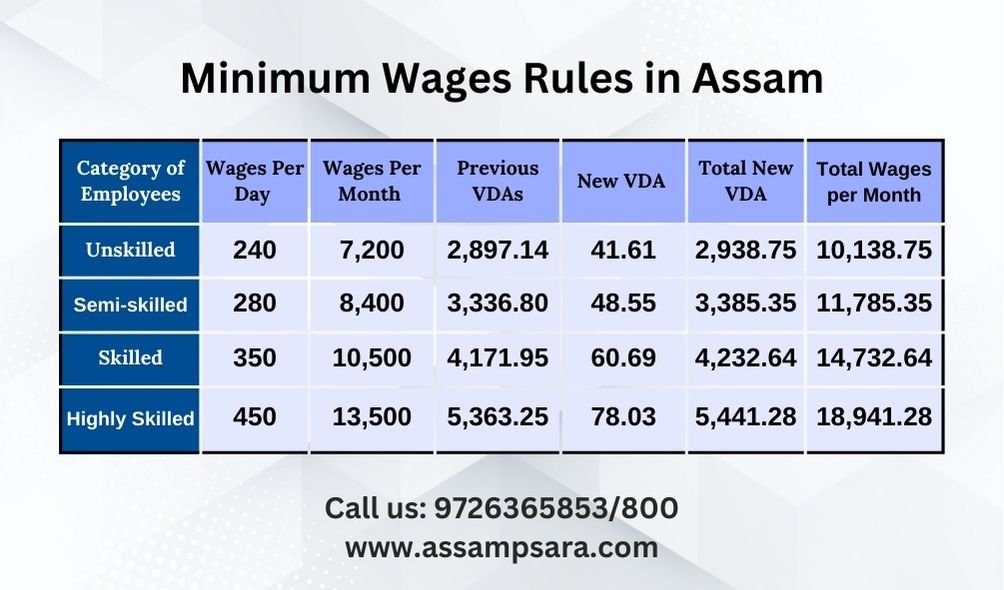

Here is the table for the current minimum wage rates and regulations in Assam:

Category of Employees | Wages Per Day (₹) | Wages Per Month (₹) | Previous VDAs (₹) | New VDA (₹) | Total New VDA (₹) | Total Wages per Month (₹) |

Unskilled | 240 | 7,200 | 2,897.14 | 41.61 | 2,938.75 | 10,138.75 |

Semi-Skilled/Unskilled Supervisory | 280 | 8,400 | 3,336.80 | 48.55 | 3,385.35 | 11,785.35 |

Skilled/Clerical | 350 | 10,500 | 4,171.95 | 60.69 | 4,232.64 | 14,732.64 |

Highly Skilled | 450 | 13,500 | 5,363.25 | 78.03 | 5,441.28 | 18,941.28 |

This table shows the updated wage rates, VDA (Variable Dearness Allowance), and the total wages per month for various categories of workers in Assam.

How Minimum Wage is Calculated in Assam

In Assam, the calculation of minimum wages is based on several factors, including skill level, job classification, and the cost of living. The following steps outline how the minimum wage is calculated:

- Wage Per Day:

The basic daily wage is determined for each category of workers, such as unskilled, semi-skilled, skilled, and highly skilled workers. This wage is usually specified by the state government and is subject to revisions. - Wages Per Month:

To calculate the monthly wage, the daily wage is multiplied by the number of working days in a month. Typically, there are 30 days in a month, but employers calculate wages based on actual working days (usually 26-28 days, excluding holidays). - Variable Dearness Allowance (VDA):

VDA is an additional amount added to the basic wage to account for changes in the cost of living and inflation. The VDA is revised periodically by the state government and is applicable to workers across different categories. The total VDA is added to the basic wage to determine the total wage for the month. - Total Wages:

The total wage is the sum of the basic wage (calculated from the wage per day and number of working days) and the VDA. This amount reflects the minimum wage that an employer must pay to the worker.

Example:

For an unskilled worker:

- Daily Wage: ₹240

- Monthly Wage: ₹240 x 30 = ₹7,200

- Previous VDA: ₹2,897.14

- New VDA: ₹41.61 per day

- Total New VDA: ₹2,938.75 (for the month)

- Total Wages: ₹7,200 (Basic) + ₹2,938.75 (VDA) = ₹10,138.75

Thus, the total minimum wage for an unskilled worker is ₹10,138.75 per month.

This method ensures that workers are compensated fairly, accounting for both their skills and the economic conditions.

Implementation and Enforcement of Minimum Wage Rules

Government Notifications: The government issues regular updates on minimum wage rates, which employers must follow.

Categorization of Workers: Minimum wage rates are determined based on skill levels and job functions, ensuring appropriate compensation for all workers.

Variable Dearness Allowance (VDA): VDA is periodically updated to adjust wages according to inflation and cost of living.

Employer Responsibility: Employers must pay the minimum wage, maintain accurate records, and issue payment slips to workers.

Labor Department Inspections: Regular inspections are conducted to verify compliance with wage laws and examine payrolls and attendance records.

Complaint Filing and Resolution: Workers can file complaints if they are underpaid, and the Labor Department investigates and resolves disputes.

Penalties for Non-Compliance: Employers failing to comply may face fines or legal action.

Worker Awareness: Workers are informed about their rights and how to file complaints through awareness campaigns by the Labor Department.

Judicial Oversight: Courts intervene when there are disputes or violations related to minimum wage laws.

Overall Impact: Strong enforcement ensures fair compensation, reduces exploitation, and improves the welfare of workers.

Minimum Wage Guidelines for Security Agencies and Guards in Assam

Minimum Wage Rates for Security Guards in Assam (2025):

Skill Level | Rural Areas (₹) | Urban Areas (₹) |

Unskilled Guards | ₹8,500 – ₹9,500 | ₹9,500 – ₹10,500 |

Semi-Skilled Guards | ₹9,500 – ₹10,500 | ₹10,500 – ₹11,500 |

Skilled Guards | ₹10,500 – ₹11,500 | ₹11,500 – ₹12,500 |

Highly Skilled Guards | ₹11,500 – ₹12,500 | ₹12,500 – ₹14,500 |

Key Regulations:

- Compliance with Minimum Wages:

- Employers must pay at least the stipulated minimum wage.

- Non-compliance may result in fines, penalties, and legal action.

- Record Maintenance:

- Employers are required to maintain records of wages, working hours, and attendance.

- Payment slips must be provided to workers as proof of payment.

- Working Hours and Overtime:

- Standard working hours: 8 hours/day or 48 hours/week.

- Overtime work must be paid at twice the regular wage rate.

- Employee Rights:

- Guards can file complaints with the Labor Department for underpayment or exploitation.

- Regular inspections by the Labor Department ensure compliance with minimum wage laws.

These guidelines ensure fair pay and protections for security personnel in Assam, promoting a fair and transparent working environment.

Salary Structure for Minimum Wage Workers in Assam

The following table outlines the salary structure for Minimum Wage Rules in Assam, considering various components such as basic pay, dearness allowance (DA), house rent allowance (HRA), travel allowance, and overtime pay:

Component | Rural Areas (₹) | Urban Areas (₹) |

Basic Pay | ₹12,000 – ₹13,500 | ₹13,500 – ₹15,000 |

Dearness Allowance (DA) | ₹1,200 – ₹1,500 (approx.) | ₹1,350 – ₹1,800 (approx.) |

House Rent Allowance (HRA) | ₹1,200 – ₹1,800 (if applicable) | ₹1,350 – ₹2,250 (if applicable) |

Travel Allowance | As per employer policy | As per employer policy |

Overtime Pay | As per labor laws | As per labor laws |

Total Monthly Salary | ₹14,400 – ₹16,800 | ₹16,200 – ₹19,050 |

Key Components:

- Basic Pay: The core monthly salary based on the employee’s skill level and job responsibilities.

- Dearness Allowance (DA): An adjustment to account for inflation and rising living costs, varying by region.

- House Rent Allowance (HRA): Provided to employees who live in rented accommodations, varying by urban or rural areas.

- Travel Allowance: Paid based on the employer’s policy, usually for work-related travel.

- Overtime Pay: Compensation for work done beyond standard hours, as per labour laws.

- Total Monthly Salary: The sum of the basic pay, DA, HRA, travel allowance, and overtime pay, representing the total compensation package.

This structure ensures fair compensation for workers in both rural and urban areas, with allowances for living and work-related expenses. Employers are required to adhere to these guidelines to ensure compliance with labour laws.

Conclusion: Protecting Worker Rights through Minimum Wage Compliance in Assam

Compliance with Minimum Wage Rules in Assam is crucial for protecting workers’ rights and ensuring fair compensation. By adhering to these laws, employers create a fair work environment, improve employee satisfaction, and boost productivity. Regular wage updates and allowances help maintain wages in line with the cost of living. The Labor Department’s enforcement ensures accountability. Ultimately, compliance protects workers from exploitation, promotes financial stability, and fosters a legally compliant workforce in Assam.